CERAWeek ’17: Global gas growth spurred by emerging markets, increased trade

By Adrienne Blume, Executive Editor

HOUSTON—At CERAWeek by IHS Markit’s Global Gas Plenary on Wednesday morning, panelists shared their views on how they expect gas markets to develop over the next few years.

Panelists included Datuk Wan Zulkiflee Wan Ariffin, President and Group CEO of Petronas; Simon Blakey, Senior Associate, Energy Group (Chair) at IHS Markit; Charif Souki, Chairman of the Board, Tellurian; and Michael Stoppard, Chief Strategist for Global Gas and Energy and CERAWeek Vice Chairman for IHS Markit.

Emerging markets driving gas growth. Mr. Wan Zulkiflee said that emerging markets in Southeast Asia, India, Pakistan and the Middle East will account for 70% of LNG demand growth between 2016 and 2035. Consumption growth of 30 MMtpy–77MMtpy is expected. "There is plenty of room for new business players to work together to create market opportunities," the CEO noted.

Mr. Wan Zulkiflee asserted that Petronas is ready to be a reliable and steady supplier. However, he also cautioned, "Ensuring continued investment in gas is not the sole responsibility of producers. It is also the collective responsibility of buyers, governments, contractors and, ultimately, consumers."

LNG liquidity increasing. Mr. Souki, who originally founded Cheniere Energy and is now Chairman of the Board for Tellurian, noted that the liquidity of LNG supply is increasing. In 2016, 270 MMtpy of LNG were traded; this volume is expected to increase to 365 MMtpy, which is equivalent to 12–15 cargoes traded each day.

At any given time, 200 cargoes will be on the water, which Mr. Souki called "a very significant physical market." He also noted that new LNG supply poles are emerging on the US Gulf Coast and in Qatar and Australia.

According to Mr. Souki, the US revolution "broke" the LNG chain. It separated the upstream and the downstream for the first time, severing the integrated chain. The scale of investment for the former model also meant that only IOCs and NOCs could participate. The US model created a simple FOB model that allowed for variety of players to participate in the market.

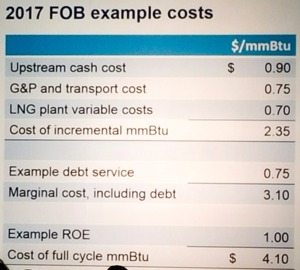

Mr. Souki gave an example of 2017 FOB costs for US LNG that pegged the full-cycle cost at $4.10/MMBtu. The full cost breakdown is shown in the slide capture.

LNG growth to surpass gas growth. Mr. Stoppard (pictured) presented IHS Markit's forecast for the global gas market. IHS expects gas to make up 25% of the energy mix by around 2040, up from 22%.

LNG will grow at a faster pace than global gas demand itself, with LNG growth set to expand from 10% to 15% by 2040. A significant amount of that increase will take place over the next couple of years. "In the last few years, LNG has moved from being a continental or regional business to being a very globalized business," Mr. Stoppard said.

"On the supply side, we keep looking for oil and finding gas," he noted. Between 2011 and 2015, discoveries of conventional gas exceeded conventional oil discoveries. Data for 2016 is still being tallied, although discoveries of conventional oil and gas appear to be "neck and neck," Mr. Stoppard said.

Growth in North America and China will be areas to watch. At present, North America comprises 29% of global gas demand. This share could rise to 39% by 2040. Meanwhile, China's gas use has increased from 5% of its economy to 15% of its economy, marking strong growth. However, IHS does not expect the country to become a totally gas-dominated market over the near term.

Huge potential also exists for LNG as a transportation fuel. However, this will not happen without action from all sides of the industry. Infrastructure must be built, and partnerships and models are needed to expand this market.

IHS forecasts strong growth for gas over the long term, but industry must be actively involved in building the gas market's future, Mr. Stoppard said.

Comments