2020 AFPM Summit: Road transport fuel recovery may be delayed to 2023

Road transport fuel recovery may be delayed to 2023

LEE NICHOLS, Editor-in-Chief/Associate Publisher, Hydrocarbon Processing

Although road fuels demand is rebounding, global consumption may not return to 2019 levels until 2023. This was the forecast presented by Linda Giesecke, Manager of Global Fuels for ESAI Energy, at the 2020 AFPM virtual Summit on Tuesday.

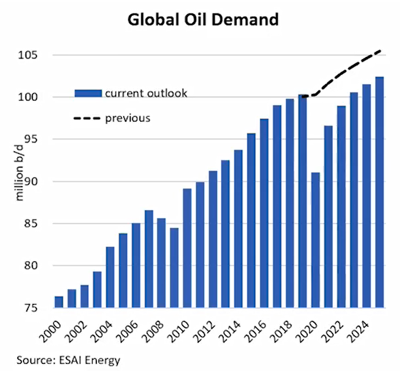

Giesecke opened her outlook for road fuels demand by discussing current oil demand and how the COVID-19 pandemic has significantly decreased global oil consumption. "If we look at 2020, it is apparent that this pandemic is ravaging oil demand," she said. Global oil demand exceeded 100 MMbpd in 2019 but has plummeted to 91 MMbpd (FIG. 1) in 2020 due to travel restrictions and work-from-home orders initiated by local, regional and federal governments. The drop in fuels demand has affected both OECD and non-OECD countries.

FIG. 1 Global oil demand has plummeted from 100 MMbpd in 2019 to 91 MMbpd in 2020. Source: ESAI Energy.

Although a COVID-19 vaccine may become available in 2021, its widespread distribution may not happen until 2022. This will likely delay global fuels demand returning to 100 MMbpd until 2023. "The delay of a global fuels rebound is partly due to jet fuel demand, which is likely to remain weak," Giesecke explained. "Our forecast calls for global fuels demand to increase to approximately 102 MMbpd by 2025, which is a delay of about four years from the ESAI forecast made prior to the global pandemic."

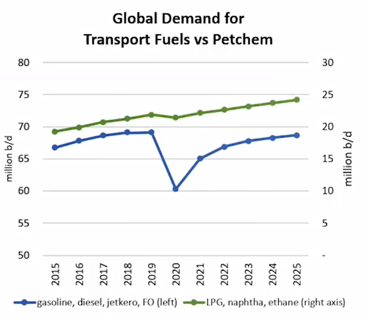

Although the pandemic has led to widespread declines in fuels consumption, it has largely spared petrochemical feedstocks. As shown in FIG. 2, global demand for transportation fuels declined sharply, while global demand for ethane, LPG and naphtha declined slightly and then rebounded to 2019 levels. "How we interpret this is that the lockdown has affected the movement of people, but not as much the use of goods."

FIG. 2 Global demand for transport fuels vs. petrochemicals. Source: ESAI Energy.

A rebound in transportation fuels will largely depend on how countries control the spread of the virus. The lifting of lockdowns has led to increased fuels demand. Several regions—Europe, parts of Asia and the U.S.—have witnessed an increase in mobility and fuels demand since lockdown restrictions have been eased.

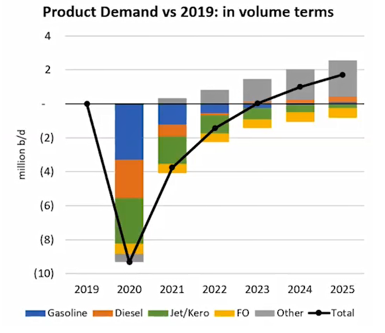

However, even with fewer travel restrictions, global fuels demand will have a long road to recovery. FIG. 3 shows refined product demand vs. 2019 levels. Global fuels demand is expected to increase, but will not reach 2019 levels until 2023. "Global demand for gasoline will still be 5% lower in 2021 vs. 2019 levels," Giesecke said. "That might not sound like much, but that 5% equals approximately 1 MMbpd lower than 2019 demand. Global diesel demand recovery will depend on how the global economy pulls out of the recession. Diesel's demand recovery to 2019 levels may take two years. Jet fuel, which has been hit hardest during the pandemic, will take more time to recover. Business travel and tourism is not likely to return to pre-COVID-19 levels until the pandemic is under control. Jet fuel demand is approximately 20% below 2019 levels in 2021 and will remain below 2019 levels until at least 2025."

FIG. 3 Product demand for 2020–2025 vs. 2019, in volume terms. Source: ESAI Energy.

Against the backdrop of the pandemic, the global refining industry is transitioning into a greener industry. Many nations around the world are instituting policies and regulations to make it mandatory for refiners to produce ultra-low-sulfur transportation fuels, to increase biofuels blending, to promote the adoption of electric vehicles (EVs), to increase CAFE standards, to institute carbon taxes, to build green transportation systems, and to increase the use of renewables and/or ban internal combustion engines (ICEs) in cities.

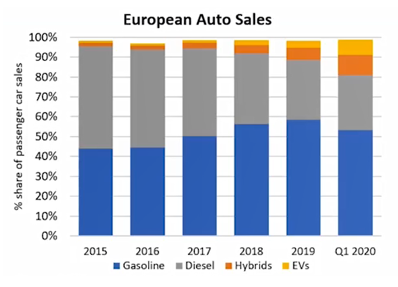

These policies can affect future fuels demand. For example, EV sales in Europe have gained market share over the past five years (FIG. 4). Although ICE vehicles account for most European vehicle sales, EV sales are gaining traction. In Europe, alternative vehicles are eroding ICE vehicle sales at an increasing pace.

"The displacement of gasoline and diesel demand by EVs is still relatively small, but the accelerating momentum of EVs, combined with the rising sales of hybrid vehicles and higher CAFE standards for ICE vehicles, all serve to chip away at Europe's 7 MMbpd of pre-pandemic gasoline and road diesel demand," said Ms. Giesecke.

FIG. 4 European vehicle sales market share by type. Source: ESAI Energy and the European Automobile Manufacturers' Association.

Comments