2021 AFPM Summit Virtual Edition: Can the global plastics industry decarbonize?

ANDREW BROWN, Head of Polymer Demand, and ASHISH CHITALIA, Head of Global Polyolefins, Wood Mackenzie

Despite the “war on plastics,” plastic demand over the coming decades will be robust, underpinned by the growing global middle-class and the material requirements of the energy transition.

As an energy-intensive industry with carbon as a major feedstock, emissions in the chemicals and plastics sector will continue to grow at a rate that is at odds with Paris commitments without significant intervention, according to Wood Mackenzie’s Materials Application Platform (MAP).

The COP26 climate conference in Glasgow, Scotland from October 31–November 12, is seen by many as an opportunity to cement a global green agenda. While reductions will be decided at an international and national level, the main impacts will be felt by individual industries and companies. This includes the plastics sector and associated polymer value chains.

Why must the plastics industry decarbonize? As a subset of the industrial sector, the polymer value chain was responsible for only 4% of energy-related emissions in 2020. In our base case view, which is broadly consistent with a 2.8°C–3°C global warming trajectory, growing demand would see this rise to around 7% in 2040. However, in our proprietary Accelerated Energy Transition–1.5 (AET–1.5) scenario, which sees the rise in global temperatures since pre-industrial times limited to 1.5°C, as other sectors aggressively decarbonize, the polymer value chain could be responsible for as much as a third of total energy-related emissions.

Failure to address this reality will not only mean that broader targets are more difficult to achieve, but costs in the plastics industry will rise as carbon emissions are penalized through taxes, pricing mechanisms and regulations.

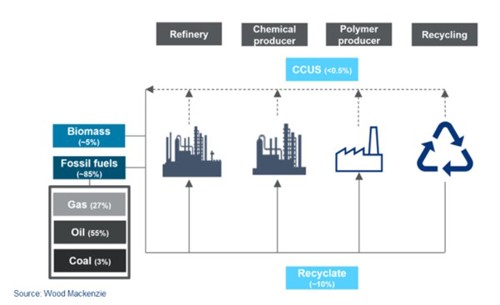

Can the industry decarbonize? The short answer is, “Yes,” but it will take a lot of work. The polymer value chain, through which plastics are created and distributed, is inextricably tied to carbon (FIG. 1); 85% of plastics produced are derived from hydrocarbons. Fossil fuels also act as a primary energy source for production facilities and are integral to the vast distribution and logistics networks within the industry. Full decarbonization is unlikely.

However, driving down net carbon emissions is both possible and necessary to safeguard the industry’s future. Fortunately, it is possible to achieve significant overall reductions in net emissions from polymer production by addressing the issue at every stage of the value chain.

FIG. 1. Potential sources of carbon for polymer value chains (% feedstock in 2020).

Where can carbon emissions reductions be made? Avoiding carbon heavy feedstocks (coal/gasoil), upgrading to the more efficient plants and latest technologies, and enhancing the renewable electrification can minimize carbon leakage. All three would drive out a reasonable proportion of net emissions in the production process.

However, in isolation, they will not be enough. The industry must rapidly scale up its use of renewable carbon. While biopolymers and carbon capture, utilization and storage (CCUS) offer routes, the biggest and quickest way to build scale lies in ramping up the rate of recycling. As well as driving down emissions relative to virgin production, this route has the added advantage of dealing with the other major environmental challenge facing the industry: plastic waste.

Even under our AET–1.5 scenario, polymer value chains would be producing 1.4 Gt CO2-eq at a point when the world should be at net zero. This is the equivalent to the emissions of 350 coal-fired power plants or the carbon sequestered by a forest approximately 75% the size of Brazil. While net zero implies that not all emissions will be displaced, it is likely that under this scenario more will be needed from the polymer value chain.

The most likely routes to achieving further decarbonization would be through the adoption of more expensive renewable feedstocks—driving up costs for the industry—or in further demand reduction. Neither approach is likely to be palatable. However, early action to scale and reduce the cost of carbon saving technologies is the best defence against these end points.

ABOUT THE AUTHORS

Andrew Brown heads the Wood Mackenzie polymer demand modelling team, forecasting across multiple value chains. His work includes identifying and analyzing trends across sustainability, recycling and consumer preferences to develop and integrate base case and alternative scenario views for the future.

Ashish Chitalia leads polyolefins research at Wood Mackenzie, with responsibility for developing strategic tools and analytics products to integrate commodity polyolefins into the existing Wood Mackenzie chemicals research. Prior to Wood Mackenzie, Mr. Chitalia held various roles in research and consulting for commodity and value-added products. He has a broad background in projects ranging from refining to petrochemicals, solvents to specialty polymers, and catalysts to plastics converter goods.

Comments