EIA Short-Term Energy Outlook: US liquid fuels

NEW YORK (Reuters) - US crude oil production is expected to average 12.06 MMbpd in 2019, passing the 12-MMbpd milestone sooner than expected on surging domestic shale output, according to the latest US Energy Information Administration report.

For 2019, production is expected to rise 1.16 million bpd from the prior year, more than EIA’s previous forecast for a 1.02-million bpd rise.

The agency’s monthly report said EIA expects production to surge above 12 million bpd in the second quarter of 2019, sooner than its previous estimate of the fourth quarter.

Output this year is forecast to rise by 1.55 million bpd to 10.90 million bpd. That projected increase is an upward revision from its earlier estimate of a 1.39 million bpd rise.

A shale revolution has helped push U.S. crude production to record highs, rivaling top producer Russia and outpacing Saudi Arabia. Russian oil output reached another 30-year high of 11.41 million barrels per day in October.

The increase in U.S. production has largely come from the Permian basin, the largest U.S. oilfield, and the Bakken, where production has soared to new peaks.

“U.S. crude oil production reached a record milestone in August 2018, when it exceeded 11 million barrels per day for the first time,” EIA Administrator Linda Capuano said.

“U.S. production has exceeded EIA’s previous expectations and, as a result, the short-term outlook now forecasts U.S. crude oil production to exceed 12 million barrels per day in 2019.”

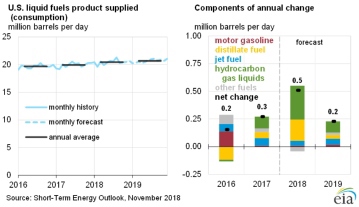

For 2018, U.S. oil demand is expected to rise by 510,000 bpd to 20.47 million bpd, EIA said, slightly raising its previous forecast of a 450,000 bpd rise to 20.41 million bpd.

For 2019, oil demand is estimated to rise by 220,000 bpd, a small downward revision from the previous estimate of a rise of 230,000 bpd.

As supply grows, the oil market has grown more concerned about the demand outlook, particularly as trade tensions between the United States and China threaten growth in the world’s two biggest economies and as currency weakness pressures economies in Asia.

Oil prices fell on Tuesday with U.S. crude touching the lowest since early April.

- EIA expects Brent spot prices will average $72 in 2019 and that West Texas Intermediate (WTI) crude oil prices will average about $7/b lower than Brent prices next year. NYMEX WTI futures and options contract values for February 2019 delivery that traded during the five-day period ending November 1, 2018, suggest a range of $53/b to $83/b encompasses the market expectation for February WTI prices at the 95% confidence level.

- EIA estimates that U.S. crude oil production averaged 11.4 million barrels per day (b/d) in October, down slightly from September levels because of hurricane-related outages in the Gulf of Mexico. EIA expects that U.S. crude oil production will average 10.9 million b/d in 2018, up from 9.4 million b/d in 2017, and will average 12.1 million b/d in 2019.

- U.S. regular gasoline retail prices averaged $2.86 per gallon (gal) in October, an increase of 2 cents/gal from the average in September, marking the sixth consecutive month that U.S. prices averaged between $2.85/gal and $2.90/gal. EIA forecasts the average U.S. regular gasoline retail price will fall to $2.57/gal in December 2018. EIA forecasts that regular gasoline retail prices will average $2.75/gal in 2018 and in 2019.

Read the full EIA report at https://www.eia.gov/outlooks/steo/report/us_oil.php

Comments