Libya's troubled oil sector sees new revival

Libya’s oil sector, shattered by unrest since the toppling of long-time leader Muammar Gaddafi in 2011, is back on the rise.

The easing of a blockade by eastern forces, which had cut output by more than 90% to around 100,000 bpd, has seen production recover to about 500,000 bpd. The government in Tripoli expects that to double by year-end.

But after years of repeated shutdowns, damage to infrastructure and lack of investment, a return to the country’s pre-civil war capacity of 1.6 million bpd appears some way off.

Here are the latest developments:

AGOCO

National Oil Corp (NOC) subsidiary Arabian Gulf Oil Company (AGOCO) is producing around 190,000-200,000 bpd.

The company has not yet restarted the al-Bayda or Nafoora oilfields because pumping is carried out through Es Sider port, which remains under force majeure.

SHARARA

Libya’s biggest oilfield resumed operations on Oct. 11 at an initial production rate of around 40,000 bpd. By Oct. 19, the field was already producing at around half its 300,000 bpd capacity.

Crude from the field feeds the 120,000 bpd Zawiya oil refinery, with the rest exported from the Zawiya oil terminal. Three 600,000 barrel cargoes are slated for export in October.

MARSA EL HARIGA

NOC lifted force majeure on loadings on Sept. 19. Unipec loaded the first cargo from the terminal shortly after.

ZUEITINA

NOC lifted force majeure at the terminal on Sept. 22.

Shipping sources expect loadings to average around 80,000 bpd in October.

ABU ATTIFEL

The 70,000 bpd oilfield is expected to begin its restart on Oct. 24.

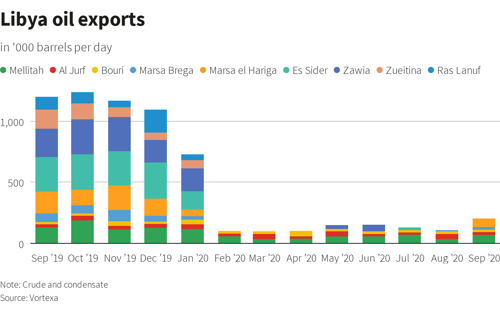

For a graphic on Libya oil exports:

HOW TO GET TO 1 MILLION BARRELS PER DAY

The next big rises in Libyan oil production will come from the resumption of exports from the eastern terminals of Ras Lanuf and Es Sider, and the El Feel oilfield in the southwest.

Restarts at those sites could propel Libyan production above 1 million bpd.

ES SIDER

In September-December 2019, the terminal exported an average of nearly 300,000 bpd of crude, according to data from oil analytics firm Vortexa.

RAS LANUF

In September-December 2019, the terminal exported an average of nearly 110,000 bpd of crude, according to Vortexa. Exports in December 2019 hit nearly 190,000 bpd, the data show.

EL FEEL

The 70,000 bpd oilfield remains offline. It depends on its power supply from Sharara, so restart could be imminent.

El Feel and Wafa field condensate make up the Mellitah blend which is exported from Mellitah terminal, operated by NOC and Italy’s ENI.

Reporting by Ahmad Ghaddar; Editing by Mark Potter

Comments