GlobalData: LSFO emerging as preferred bunker fuel following IMO 2020 regulation

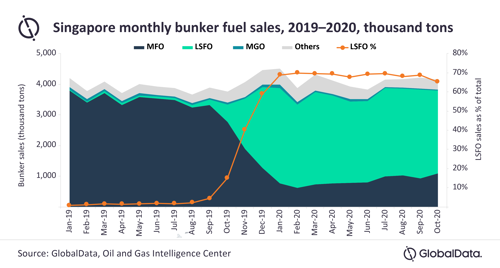

Despite its relatively high cost, both shipping companies and refiners are placing bets on low sulfur fuel oil (LSFO, 0.5% sulfur m/m) for marine transportation. As a result, LSFO sales in Singapore, the world’s largest bunkering hub, have increased from 174 thousand tons in September 2019 to 2,896 thousand tons in September 2020, says GlobalData, a leading data and analytics company.

GlobalData’s latest thematic report, "IMO 2020" evaluates the impact of the International Maritime Organization’s (IMO) sulfur regulation, effective from 1 January 2020, on the crude oil refining sector.

Since Q4 2019, Shell, Total, Sinopec, and other refiners were stockpiling LSFO at major hubs like Singapore, Antwerp, and Rotterdam for seamless transition to IMO 2020. This enabled shippers, including Maersk, Mediterranean Shipping Company (MSC), and Cosco to switch to LSFO from late 2019 itself. However, its availability was much lower than high-sulfur fuel oil (HSFO), causing the spread between the fuels to reach around US$300 per ton in January 2020.

Ravindra Puranik, Oil and Gas Analyst at GlobalData, comments: “Maersk introduced the EFF to offset the high price of LSFO. The company started levying a surcharge of US$50–200 per forty-foot equivalent unit (FEU) from March 2020 onwards.”

Shippers are also using exhaust gas cleaning systems (EGCS) or scrubbers to comply with IMO 2020. However, regulations over discharge of wash water from scrubbers vary globally, limiting the deployment of vessels equipped with these systems. Moreover, the COVID-19 pandemic caused severe disruption in supply chains at shipyards, causing a massive backlog of ships needing scrubber installations.

Puranik adds: “Lockdowns from COVID-19 led to a brief closure of shipbuilding yards globally, which led to delays in retrofitting of scrubbers. Due to these delays, shippers, such Stolt-Nielsen from Norway, cancelled their plans to install scrubbers in April 2020.”

Prior to the pandemic, refiners were hoping to profit from the higher price of LSFO. However, global energy demand crashed as countries went into lockdowns. Demand for bunker fuel alone is estimated to have fallen between 7-17% in 2020. Naturally, commodity prices have also dropped.

Puranik concludes: “The pandemic has created new problems for shippers and refiners alike. Refiners have to contain with low demand for fuels, overflowing storages, and disruptions to ongoing expansion works. The second wave of COVID-19 has further heightened the fuel demand uncertainty, causing refiners such as Shell and Marathon Petroleum to permanently close some of their facilities.”

Information based on GlobalData’s report: ‘IMO 2020’

Comments