U.S. summer gasoline exports reach new highs

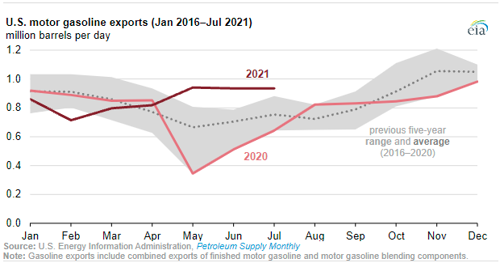

Motor gasoline exports from the United States reached record highs in May, June, and July for each of these months, according to Petroleum Supply Monthly (PSM). Summer exports in May, June, and July reflect a departure from the historical seasonality of gasoline exports because gasoline export levels are usually low during the summer.

In May, exports of motor gasoline (the combination of exports of finished motor gasoline and motor gasoline blending components) averaged 941,000 barrels per day (bpd), or 276,000 bpd (41%) more than the five-yr (2016–2020) average for May. June exports averaged 935,000 bpd, exceeding its five-yr average by 230,000 bpd (33%). In July, gasoline exports again averaged 935,000 bpd, exceeding the five-yr average for July by 181,000 bpd (24%).

Gasoline exports from the United States are typically highest in the winter and early spring, when domestic gasoline demand is lower and refinery operations continue at the summer and fall pace to meet seasonally higher distillate demand. For that reason, refineries produce more gasoline during the winter and early spring than U.S. consumption, and the extra production contributes to rebuilding seasonal inventories and to sending exports.

During the summer, more domestic consumption often reduces the availability of gasoline for export, contributing to lower exports during that time of the yr. Although the export volumes during this May, June, and July are noteworthy because of their elevated levels during the summer, the United States usually exports more gasoline during the later mos of the calendar yr.

The United States exports distillate fuel oil to a relatively diverse set of destinations, but U.S. exports of motor gasoline go primarily to Mexico. Exports to Mexico typically accounted for between 50% and 70% of all U.S. gasoline exports over the past five yrs. Gasoline exports to Mexico were a major contributor to the increased summer exports this yr.

Mexico imported more gasoline than average between May and July 2021 for several reasons. A refinery fire at PEMEX’s 285,000-bpd Minatitlan refinery required extensive repairs, resulting in reduced PEMEX gasoline production in May and June compared with their five-yr averages, based on reports from PEMEX. Also, a cyberattack in the United States temporarily disrupted the ability to move gasoline and other products along the critical Colonial Pipeline system in May, which might have encouraged Gulf Coast refiners to export volumes to Mexico that would otherwise have been distributed within the United States.

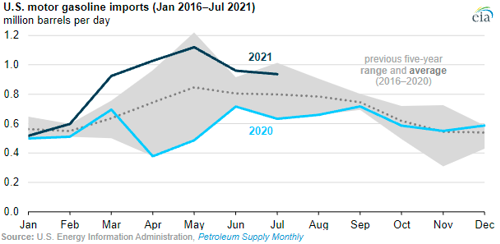

Gasoline exports were elevated during the summer, but the United States has also imported more gasoline by month through most of this yr than the previous monthly five-yr averages. U.S. cold weather refinery outages in February led to increased gasoline imports in March to compensate for the lost production. Even after U.S. refinery production resumed, imports have remained above the five-yr average and often above the five-yr high.

Principal contributor: Kevin Hack

Comments