EIA predicts falling crude oil prices in 2022

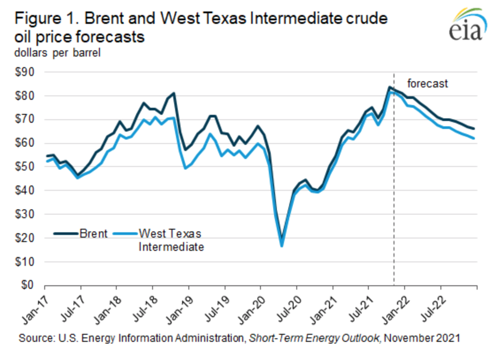

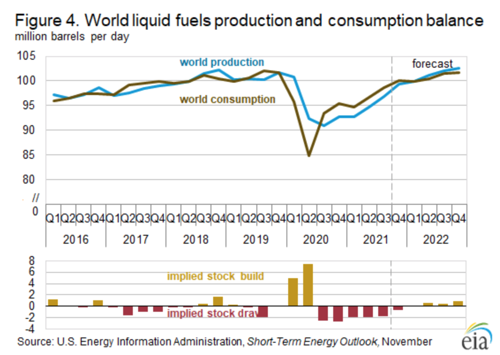

Since the third quarter in 2020, global demand for crude oil and petroleum products has increased faster than production, which has led to inventory draws and increasing crude oil prices. In February 2020, before the World Health Organization declared COVID-19 a pandemic, the spot price for Brent crude oil averaged $56 per barrel (b) and $51/b for West Texas Intermediate (WTI). The spot prices for Brent fell to $18/b and WTI to $17/b in April 2020 because of the significant decline in demand caused by the pandemic. Prices have since increased and are now above pre-pandemic levels because of returning demand and slow global oil production growth. In October, the price of Brent crude oil averaged $84/b, and the price of WTI averaged $81/b, the highest nominal prices since October 2014. In the EIA's November Short-Term Energy Outlook (STEO), they forecast that global liquid fuels inventories will begin building in 2022, driven by rising production from OPEC+ and the United States, which will contribute to falling crude oil prices.

The EIA forecasts that crude oil prices will begin declining in November 2021 and will decline through 2022. We expect that the price of WTI will fall from an average of $76/b in January 2022 to $62/b in December and that the price of Brent will fall from $79/b in January 2022 to $66/b in December.

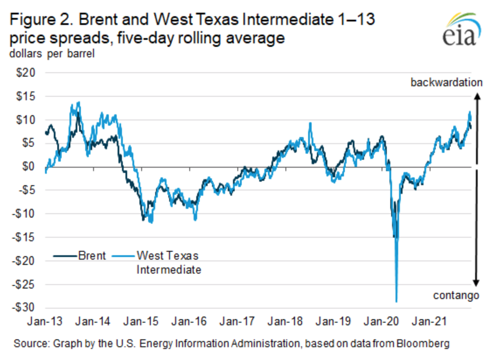

The futures markets are similarly showing high prices in the near term compared with longer-dated contracts. Crude oil stock levels, among other factors, affect the relationship between near-term and longer-term futures prices. Differences in prices between crude oil contracts for delivery in the near term compared with contracts for delivery at later dates indicate market expectations that stock draws will moderate. Low crude oil inventories, both globally and in the United States, have put upward price pressure on near-dated contracts, whereas longer-dated contract prices likely reflect expectations of a more balanced market. Because of the upward price pressure on the near-term contracts, near-dated contracts have higher prices than longer-dated contracts, a situation referred to as backwardation. When near dated contracts have lower prices than longer-dated contracts, it is known as contango.

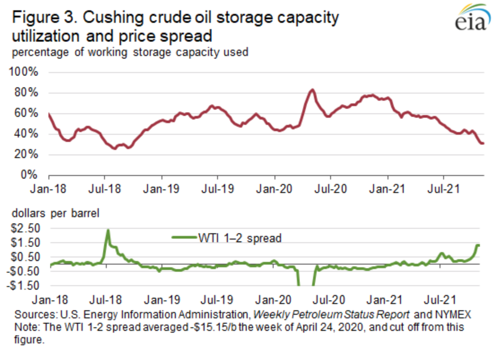

As of November 9, the Brent front-month contract (January delivery) was $85/b, and the WTI front-month contract (December delivery) was $84/b. The five-day moving average of the difference between the price for the first month’s contract and the thirteenth month’s contract (the 1–13 spread) for Brent reached $9.35/b on November 2, up from $0.96/b on January 4. The Brent 1–13 spread on November 2 was the highest spread since September 13, 2013. The 1–13 spread for WTI on November 2 was $11.66, up from $0.88 on January 4 and the highest spread since September 20, 2013. The 1–13 spreads have come down slightly recently, and as of November 9, the Brent 1–13 spread was $8.82, and the WTI 1–13 spread was $11.21. Low inventories in the United States—particularly in the transportation and storage hub of Cushing, Oklahoma, where the NYMEX WTI futures contracts are physically settled—are likely contributing to the additional backwardation in WTI compared with Brent.

On November 5, US crude oil inventories were 435.1 MM bbl, 6% below the previous five-year (2016–2020) average. Crude oil inventories in Cushing, however, were 26.4 MM bbl, 50% below the previous five-year average and 31% of the working storage capacity (the lowest share since September 2018). Backwardation over the short term (first- and second-month contracts) reflects the low inventory levels. A shift in crude oil flows away from Cushing while the Capline pipeline is being filled is likely contributing to low crude oil inventories in Cushing. The Capline pipeline is expected to reverse the flow direction to move crude oil to the U.S. Gulf Coast in early 2022.

During the past decade, similarly high levels of backwardation in Brent and WTI crude oil have typically occurred only during periods of large, unplanned supply disruptions. This year, however, the significant decline in inventories and resulting backwardation are the result of a large increase in demand as well as restrained crude oil production levels among OPEC+ members. At its November 4 meeting, OPEC+ reaffirmed its commitment to maintain its scheduled crude oil production increase of 400,000 bpd in December rather than increase production by more in response to high crude oil prices and increasing demand.

The EIA estimates that world crude oil consumption has exceeded crude oil production for five consecutive quarters going back to the third quarter of 2020. During this period, total petroleum inventories among OECD countries fell by 424 MM bbl—from 9% above the five-year average in June 2020 to 7% below the five-year average at the end of September 2021. The EIA forecasts global crude oil demand will exceed global supply through the end of the year, contribute to some additional inventory draws, and keep the Brent crude oil price above $80/b through December. However, the EIA forecasts that global oil inventories will begin building in 2022, driven by rising production from OPEC+ and the United States, along with slowing growth in global oil demand. The EIA expects this shift will put downward pressure on the Brent price, which averages $72/b for 2022 in our forecast.

US average regular gasoline and diesel prices increase

The US average regular gasoline retail price increased 2 cents to $3.41 per gallon on November 8, $1.31 higher than a year ago. The Midwest price increased more than 4 cents to $3.26 per gallon, the Gulf Coast price increased nearly 4 cents to $3.10 per gallon, and the West Coast price increased nearly 3 cents to $4.13 per gallon. The Rocky Mountain price decreased nearly 1 cent to $3.55 per gallon, and the East Coast price decreased less than 1 cent, remaining virtually unchanged at $3.34 per gallon.

The US average diesel fuel price increased less than 1 cent, remaining virtually unchanged at $3.73 per gallon on November 8, $1.35 higher than a year ago. The West Coast price increased nearly 5 cents to $4.37 per gallon, and the Rocky Mountain price increased nearly 2 cents to $3.83 per gallon. The Midwest and East Coast prices each decreased nearly 1 cent to $3.63 per gallon and $3.71 per gallon, respectively, and the Gulf Coast price decreased less than 1 cent to $3.48 per gallon.

Propane/propylene inventories decline

US propane/propylene stocks decreased by 1.3 MM bbl last week to 74.8 MM bbl as of November 5, 2021, 12.6 MM bbl (14.4%) less than the five-year (2016-2020) average inventory levels for this same time of year. East Coast, Midwest, and Rocky Mountain/West Coast inventories decreased by 1.1 MM bbl, 0.3 MM bbl, and 0.2 MM bbl, respectively. Gulf Coast inventories increased by 0.2 MM bbl.

Residential fuel prices increase

As of November 8, 2021, residential heating oil prices averaged more than $3.41 per gallon, nearly 2 cents per gallon above last week’s price and more than $1.27 per gallon higher than last year’s price at this time. Wholesale heating oil prices averaged almost $2.58 per gallon, more than 2 cents per gallon below last week’s price but nearly $1.29 per gallon above last year’s price.

Residential propane prices averaged almost $2.74 per gallon, nearly 2 cents per gallon above last week’s price and more than 90 cents per gallon above last year’s price. Wholesale propane prices averaged almost $1.52 per gallon, nearly 2 cents per gallon below last week’s price but almost 81 cents per gallon above last year’s price.

Comments