EIA: Growing octane needs widen price spread between premium, regular gasoline

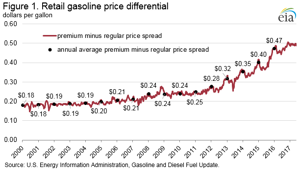

In late 2016, the difference between US average retail prices for premium and regular gasoline reached 50 cents/gal. This price spread has been generally expanding since 2000, and the rate at which the spread has grown has accelerated over the past 3 yr. Many factors on both the supply and demand sides are likely influencing this trend.

On the demand side, since 2013, the premium gasoline share of total motor gasoline sales has steadily increased, reaching a near 13-yr high of 11.9% in August 2016. While lower gasoline prices may be supporting demand for premium gasoline, the upward trend in sales is more likely driven by changes in fuel requirements for light-duty vehicles in response to increasing fuel economy standards. To meet these standards, more car manufacturers are producing models with turbocharged engines that may require or recommend the use of high octane gasoline.

This long-running trend has occurred at the same time as significant changes in the costs to produce and supply octane for gasoline. Environmental regulations have eliminated some historical octane sources such as tetraethyl lead and methyl tertiary-butyl ether (MTBE), which were banned in 1996 and 2006, respectively. Other policies, including the federal Renewable Fuel Standard, promoted the widespread blending of fuel ethanol. Ethanol blended into gasoline has an average octane rating of 115, significantly higher than the gasoline octane rating at retail stations for regular (87 octane) and premium (91-93 octane) gasoline. However, there is relatively limited demand for, and challenges associated with, blending ethanol into gasoline in concentrations greater than 10%. Fuel ethanol’s share of the total gasoline pool grew rapidly over the 2000 to 2012 period to reach about 10%, but share growth has slowed down since that time. This situation has limited the further contribution of incremental ethanol blending as a source of additional octane in recent years, at the same time as changes in US gasoline demand patterns and supply patterns were tending to raise the need for high-octane blendstocks.

Since 2013, US gasoline demand has been increasing at an annual average of 1.8% and in 2016 surpassed the previous high it had reached in 2007. The combination of increasing overall gasoline demand, increasing demand for premium gasoline, and the difficulty of increasing ethanol blending beyond the 10% level appear to have contributed to an octane shortage that required refiners and blenders to acquire more expensive sources of octane, causing the price differential between premium and regular gasoline to increase rapidly beginning in 2014.

Supply factors have likely also contributed to the increasing price spreads as light crude oils from expanding US production of light-tight crude oil were increasingly integrated into US refineries’ crude slates. While many of these light crude oils yield large quantities of naphtha, the light distillate liquid hydrocarbon from which gasoline is made, these volumes contain higher average levels of paraffins that depress the octane level of the stream. There is also additional octane loss resulting from more intensive hydro-treating needed to meet new gasoline specifications set in January 2017. In refineries, naphtha is processed into several products, including gasoline and petrochemical feedstocks, depending on its chemical characteristics. As a gasoline blendstock, naphtha has a low octane rating, limiting how much can be blended into gasoline.

As the processing of growing volumes of domestic light crude oil at US refineries served to increase average yields of naphtha, refiners have moved from a naphtha deficit to a naphtha surplus, i.e., from having net inputs of naphtha to having net outputs. The increased supply of low-octane naphtha available to blend into gasoline may have resulted in lower production costs for low-octane gasoline such as regular grade gasoline relative to higher-octane gasoline such as premium.

For refiners, the cost of octane depends largely on reforming operations in a refinery unit that processes naphtha into the high-octane blendstock reformate. With surplus naphtha at US refineries, reformer runs recorded consecutive year-over-year increases from November 2014 to July 2016.

However, reformer operations involve a tradeoff between higher volume (i.e., more reformate produced but with lower octane) and octane (i.e., less reformate produced but with higher octane). Therefore, running reformers at higher volume levels favors production of lower-octane reformate, likely requiring other costlier additional sources of octane and increasing the costs of producing high-octane gasoline.

As US gasoline demand continues to increase and US refineries have expanded their distillation capacity to process crude oil, there has not been a corresponding increase in the capacity of refinery units that produce high-octane blending components. In addition to reformers, isomerization and alkylation units are other sources of high-octane blendstocks within refineries. Since 2007, US refineries have typically seen reductions in, or slower expansions of, octane production capacity, specifically reformers, relative to atmospheric crude distillation capacity.

An additional factor affecting markets for naphtha has been the increasing competition between hydrocarbon gas liquids (HGL) and refinery-produced naphtha as a petrochemical feedstock. Increased HGL production has lowered HGL prices and increased their competitiveness versus naphtha in the petrochemical feedstock market. As more petrochemical feedstock demand has switched to HGL, the surplus of naphtha has increased further.

HGL feedstock competition with naphtha is not unique to the United States. Recent increases in US propane, butanes, and, more recently, ethane exports to the rest of the world have contributed to naphtha displacement overseas.

Regulatory changes have likely also influenced the growing spread between regular and premium gasoline. In January 2017, Tier 3 gasoline sulfur regulations went into effect, limiting the sulfur content of gasoline. Removing sulfur from gasoline results in a slight loss of octane.

Other regulations to limit or remove other substances such as benzene from gasoline may also have indirect consequences for octane, as reformate has a high benzene content. Meanwhile, newly implemented and planned regulations on gasoline specifications and emissions in China, India, Indonesia, and Africa will likely increase the demand for high-octane gasoline and higher octane blendstocks globally.

To date in 2017, the growth in the price spread between premium and regular gasoline has stalled, holding near 50 cents/gal. Possible reasons include a slightly lower share of premium gasoline sales recently and the influence of higher retail gasoline prices. However, considering the combination of factors influencing demand and supply of octane, EIA expects price spread increases to resume in the future.

Comments