Freedonia Group: Global demand for refining catalysts to reach $4.7 B in 2020

Global demand for the refining catalysts market, which includes catalysts used in fluid catalytic cracking (FCC), hydroprocessing, alkylation, reforming and other applications, is forecast to grow 3.6%/yr to $4.7 B in 2020.

While global demand for refining catalysts in all applications will experience healthy growth, FCC catalysts will post the fastest growth and remain the largest market for refining catalysts by value. This forecast and other trends are presented in World Refining Catalysts, a new study from industry research firm The Freedonia Group.

The refining catalyst markets in developed countries are mature, with strong competition among catalyst manufacturers. To maintain and expand market share in these countries, manufacturers invest significant time and resources in the development of catalysts that can:

• Function at higher temperatures and pressures

• Lower costs by increasing crude oil feed rate or catalyst life

• Produce higher-quality end products.

The continued introduction of new catalysts will sustain growth in the mature markets of North America, Western Europe and Japan. The Freedonia Group noted, “The established nature of fuel sulfur regulations in these markets, declining gasoline consumption and decreasing refined products output will restrain stronger gains.”

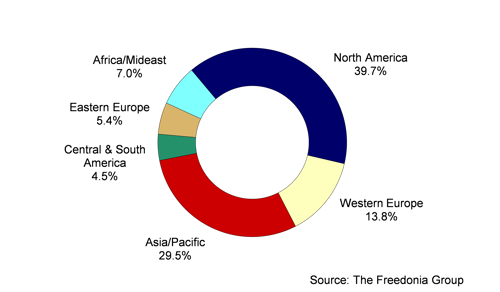

World refining catalysts demand by region, 2015—$4 B. (Graphic courtesy of The Freedonia Group)

Additionally, the changing nature of the global crude oil supply, particularly the increased availability in the US of tight oil crudes that are lower in sulfur content, may restrain growth in hydrotreating catalyst consumption in more developed markets. Opportunities will exist, though, for catalysts that allow refiners flexibility in responding to the changing nature of the crude oil supply, according to the study.

In developing economies, rising per capita incomes and increasing rates of vehicle ownership have resulted in large gains in demand for motor vehicle fuels. The growth of manufacturing in these markets and the related need to transport goods have also supported growth in demand for vehicle fuels. As a result, refined products output in developing regions is expected to expand through the forecast period, supporting overall healthy gains in demand for refining catalysts, especially in the Asia-Pacific, Africa and Mideast regions.

World Refining Catalysts was published in August 2016, and further information is available at www.freedoniagroup.com. The Freedonia Group, a division of MarketResearch.com, is a leading international industrial research company that publishes more than 100 studies annually.

Comments