Oil and gas EPC majors shift to cleaner energy

Major oil and gas engineering, procurement, and construction (EPC) companies are increasingly shifting their strategies toward cleaner energy segments.

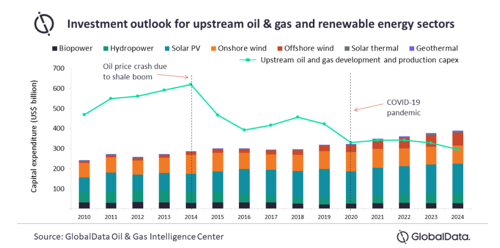

With a bleak investment outlook for the sector in the wake of COVID-19, now is seen as good a time as any for major oil and gas companies to make strategic shifts in energy transition, according to analysis by GlobalData.

Major oil and gas EPCs, which have traditionally relied on projects within the oil and gas value chain and have had relatively little exposure to renewables, are now looking to renewables and other clean energy sectors for future growth.

EPC companies are adopting diverse strategies to position themselves for the energy transition. Aker and TechnipFMC, for example, have restructured their businesses to create dedicated units for low-carbon projects. Petrofac aims to achieve net zero in Scope 1 and Scope 2 emissions by 2030. Despite these varying approaches, the most common target segments among major oil and gas EPC companies are offshore wind and carbon capture and storage (CCS).

“COVID-19 brought a major oil and gas demand shock, delayed projects and raised additional questions about the potential for future oil demand growth. Oil and gas investment is likely to flatline at best over the coming years, and companies will need to look to the growth markets of new energy sectors to support their businesses,” said Will Scargill, GlobalData managing oil and gas analyst.

“The targeting of offshore wind and carbon capture is a common theme among companies from the oil and gas sector looking to adapt for the energy transition due to the potential for knowledge synergies. Oil and gas EPCs looking to target new segments will also hope to benefit from existing partnerships with clients making a similar transition. However, their growth plans will face a challenge from incumbent players in the renewables space,” Scargill added.

Comments