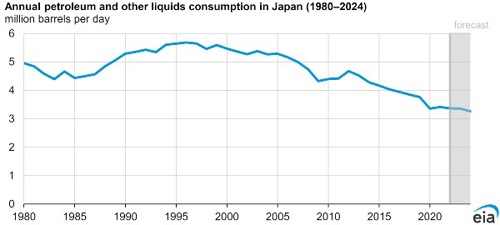

Japanese refineries close as the country's petroleum consumption falls

Data source: U.S. Energy Information Administration, Short-Term Energy Outlook, December 2023

In our Short-Term Energy Outlook, we forecast the lowest annual petroleum consumption in Japan in 2024 since at least 1980, in part due to its aging and declining population. Japan’s reduced consumption is already affecting its refining industry.

Japanese refiner ENEOS permanently closed a 120,000-barrel-per-day (b/d) refinery in western Japan in mid-October 2023, and another company, Idemitsu Kosan, plans to close a 120,000-b/d refinery in March 2024. These closures represent 7% of the country’s refinery capacity.

We forecast consumption of petroleum products in Japan will decline by 3% between 2023 and 2024 to 3.3 million b/d. Japan’s petroleum consumption declined by an average 2% per year through 2022 from its peak of 5.7 million b/d in 1996, largely because of demographic and economic changes. The oil intensity of Japan’s economy, measured as barrels of oil consumed per $1,000 of gross domestic product, has been declining.

Japan’s population peaked in 2009, and the country has seen some of the slowest economic growth among OECD countries since then. In addition, the share of Japan’s population aged 65 and older was 30% as of 2022, compared with 21% in the EU, 17% in the United States, and 14% in China, according to the World Bank.

Japan’s refineries were built mainly to serve its domestic fuel needs, and they have trouble competing in international markets. These refineries are smaller and less complex than newer refineries in Asia, including China, South Korea, and India. Complexity refers to a refinery’s secondary processing capacity, such as hydrocracking and coking, which upgrades low-value heavy fuel oil into valuable transportation fuels. More complex refineries can produce more high-value products from the crude oil they process.

Less complex refiners like those in Japan also process lighter and sweeter grades of crude oil, which are more expensive than heavier and more sour grades. Higher yields of lower-value products combined with using more expensive crude oils makes refiners in Japan less profitable and less competitive in world markets. Complex refinery margins in Asia can be 30%–50% higher than simple refinery margins.

In our recent International Energy Outlook, we project Japan’s petroleum consumption will continue to decline beyond 2024, suggesting that refiners in Japan will face additional competitive pressures.

Comments