GE O&G '17: Exec keynotes talk digitization, climate change in energy transitions

By Adrienne Blume, Editor, Gas Processing and Executive Editor, Hydrocarbon Processing

FLORENCE, ITALY—The GE Oil & Gas Annual Meeting 2017 opened on Monday, January 30 with welcome remarks by GE Oil & Gas President and CEO, Lorenzo Simonelli.

"I, like you, am here because I want to chart a new course for the industry around production and growth in 2017," Mr. Simonelli said. The CEO also noted, "It's been a great year for GE." He went on to list several of the company's achievements and recognitions, including its reception of the Petroleum Economist award for technology company of the year (Fig 1).

Mr. Simonelli spoke about the rapid evolution of GE's business, and the businesses of its partner firms across the industry, to meet the world's energy needs. "Together, we will continue to push the boundaries to bring energy to the world," he said. Mr. Simonelli noted that GE's recent merger with Baker Hughes has enhanced its portfolio across the broad spectrum of the oil and gas value chain.

Disrupting the status quo. Mr. Simonelli pointed to the disruption of conventional business operations as a necessity in the current environment. "We [GE] are heading into 2017 with the status of disrupting the status quo," the CEO emphasized.

GE will continue to bring solutions to the global energy industry, although it will not stop there. The company is taking an innovative approach to manufacturing. "We're ushering in the world's fourth industrial revolution as a digital industrial company," Mr. Simonelli said. The company will carry out this goal partly through challenging traditional operations, business models and bureaucracy.

GE also aims to positively disrupt the energy sector by innovating in close collaboration with customers and disrupting traditional product development. The company will seek the most cost-effective hardware and software technologies to change its manufacturing processes.

Pushing innovation with turbine technology. One such new technology, GE's LM9000 aeroderivative gas turbine, was on display at the event. The 65-MW turbine is designed for use in both onshore and offshore LNG applications, as well as simple-cycle, cogeneration and combined-cycle power generation applications. The turbine delivers 20% more power, 40% lower NOx emissions and a 50% longer maintenance interval, resulting in a 20% lower cost of ownership for LNG customers.

"Fewer than 24% of operators describe their operating approach as being predictive," Mr. Simonelli said. Using big data, operators can take a proactive approach by making better decisions. GE is harnessing the power of the Industrial Internet to drive much-needed transformation for industry.

IEA perspective: The changing global energy mix. Mr. Simonelli then introduced Dr. Fatih Birol, Executive Director of the International Energy Agency (IEA). Dr. Birol spoke about the factors that will shape global oil and gas markets, including key changes and challenges. "What will the global energy mix look like in the next few years to come?" he posited.

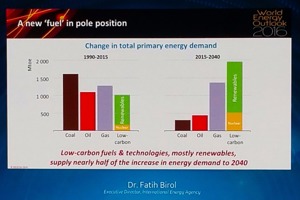

Coal was the largest component of the fuel mix from 1990–2015. The IEA envisions natural gas growing in every scenario between 2015 and 2040, as well as low-carbon technologies like nuclear and renewable energies (Fig. 2). "Renewable energies are no more a romantic story," Dr. Birol said. They are real, applicable and gaining ground in the world's energy mix.

"One fuel you don't see here [in the Fig. 2 chart] is efficiency," Dr. Birol said. "Fuel efficiency will be much stronger in the next 25 years than it has been in the last 25 years, mostly due to government policies and digitization, as Mr. Simonelli mentioned."

Demand fluctuations and fuel substitution. The IEA does not foresee a peak in global oil demand, although it may slow down, Dr. Birol acknowledged. Penetration of electric cars into the motor vehicle market is helping offset some oil demand. Less oil is expected to be used in electricity generation, especially in the Middle East. However, Dr. Birol noted, "In my view, this does not economically make much sense."

Fuel oil use for heating will also go down. "More than one-third of growth in oil demand comes from developing Asia, where efficiency standards are close to zero. The possibility of replacing oil with other fuels [in developing Asia] is not great, at least in the short and medium term," Dr. Birol said.

New trends are also being seen in investment. Approvals of new conventional crude oil projects from 2015–2016 have fallen to the lowest level since the 1950s. Also, the volume of oil discoveries in 2016 was the lowest in the last 70 years, due to less money being allotted for exploration, the Executive Director explained. If approvals for crude projects remain low in 2017, then an unprecedented effort will be needed to avoid a supply-demand gap in the next few years.

At present, all eyes are on US tight oil and shale oil developments. Cost reductions and a short investment cycle mean a quick response to short-term price signals. However, shale oil and tight oil cannot be relied upon to offset the overall drop in crude oil investment elsewhere, Dr. Birol said.

The price of natural gas will be critical to gas growth, especially in Asia. Gas will be squeezed by cheap coal, government subsidies and promotion of renewable energies, creating tough competition for gas in the electricity generation sector.

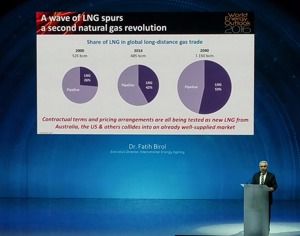

New wave of LNG. Another wave of LNG production is spurring a second natural gas revolution. "A silent revolution is taking place in North America," Dr. Birol acknowledged. "Now, another revolution—namely an LNG revolution—is on its way […] We are seeing that the share of LNG is growing substantially."

Based on projects scheduled for completion in the next five years, 130 Bcm of LNG will come to market, mainly from Australia and the US (Fig. 3). After 2020, another wave of new players is expected to come from Mozambique, Tanzania and other emerging economies.

Gas prices will move away from oil-indexed prices, and strong competition will be seen between LNG and pipeline gas. LNG will be a very important tool for gas-importing companies and countries, Dr. Birol said. "LNG provides flexibility and much more security for the global gas markets" than other hydrocarbons.

Looking to future trends. Subdued upstream investment and changing oil market dynamics are ushering in a period of greater market volatility. Continued investment in oil and gas is needed to make a smooth, low-cost energy transition.

The next wave of LNG will provide the catalyst for another natural gas revolution, with far-reaching implications for gas pricing and contracts. Also, Dr. Birol noted, digitization is opening up new pathways for technology advancements and optimization of operations in all hydrocarbon processing sectors.

Total sees opportunities arising from disruptions. Total President of Exploration and Production, Arnaud Breuillac, spoke on how disruptions may generate opportunities. The present energy environment is being shaped by a number of disruptions:

- Oil price volatility

- Uncertainty of demand growth sustainability

- Safety and environment concerns

- Importance of new players

- Higher expectation for sustainable growth

- Climate change concerns

- Supply shock, with the US shale oil and gas revolution providing abundant resources

- Impact of digitalization on industry efficiency

- World political instability

- The LNG bubble

- New market mechanisms.

"Since we have no control over oil and gas prices, we are targeting improvements to operational efficiency," Mr. Breuillac said. "Our [Total's] goal is to raise its operational efficiency to 93% in 2017."

Condition monitoring and less intrusive inspection tools will help increase operational efficiency. Total also aims to lower its investments to a more balanced level, to preserve its long-term competitiveness. The company is taking into account a 2°C climate change "roadmap" into its group strategy. Total plans to gradually decrease the carbon intensity of its production mix to offset greenhouse gas emissions.

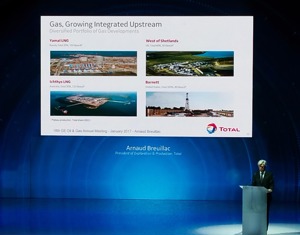

Mr. Breuillac next spoke about upcoming shale gas and LNG projects (Fig. 4), including Yamal LNG in Russia, Ichthys LNG in Australia, the Barnett shale in US, and West of Shetlands in the UK. These projects will be a major focus of development for the company in the coming years.

"During this difficult period for industry, as always, innovative is playing a key role […] necessity is the mother of invention," the E&P President said. Easier access to high-level data will save time and money and boost efficiency. Operating personnel will have instant access to data, enabling them to make immediate decisions and prevent accidents before they occur, as well as save costs. This will help improve company and industry safety and environmental performance.

Ambitions for next 20 years. The oil and gas industry must meet the energy needs of a growing world population in which 1.3 billion people have limited or no access to energy, at present. The industry must also address climate change while understanding and adapting to customers' use and relationship to energy. Total will respond by providing reliable, affordable and clean energy over the long term, Mr. Breuillac said.

Stay tuned for more coverage. More coverage of key speaker presentations and technology sessions from the GE Oil & Gas Annual Meeting is forthcoming, so keep an eye on our site for updates!

Comments