IRPC '17: Refinery/petrochemical integration creates operational efficiencies

By Adrienne Blume, Executive Editor

NEW DELHI, INDIA—During Day 2 of IRPC 2017, Ashish Logani, Principal Process Engineer at Fluor, shared insights on how to overcome the challenges associated with integrating petrochemicals production and refining operations.

Drivers and challenges for refinery/petrochemical integration. Conventional operating modes of standalone refineries are not generating enough margins, Mr. Logani said. "Standalone refinery complexes do not stand in this world now. People are finding ways to integrate and make a coordinated, better [processing] complex."

Refinery/petrochemical integration is characterized by a number of drivers and challenges. For refining, these include:

- Processing heavier and sulfur-rich crudes

- Increasingly stringent environmental regulations

- Enhanced product specifications for sulfur, aromatics, cetane and RVP

- Evolving regional supply and demand dynamics for diesel versus gasoline

- High price of energy and utilities

- Shortage of hydrogen

- Limited monetization of C2, C3 and C4

- Low refining margins.

For petrochemical producers, drivers and challenges include:

- Olefinic feedstock availability and price volatility

- Better margins

- High-value downstream integration opportunities

- Regional supply and demand dynamics for ethylene and propylene

- High prices for energy and utilities

- Competitive pressure of globalization

- Limited monetization of streams such as pyrolysis gasoline, hydrogen, and C4=.

Benefits of integration. Many benefits exist for refinery/petrochemicals integration. Higher returns on existing and new assets can be secured through reductions in CAPEX, the establishment of a high-value product chain (i.e., depressed products from one chain can become valuable feedstock for another) and additional opportunities for diversification in premium chemicals.

Operational efficiencies and flexibility can be achieved through optimized crude baskets, increased flexibility in gasoline blending and aromatics management, better management of FCC propylene and hydrogen, and increased flexibility to respond to market changes for fuels and chemicals.

Single-site benefits include reduced storage needs, the possibility of hot feeding, reduced transportation costs and lower utilities redundancy. Improved utilization of infrastructure, synergies in support functions, optimized resource allocation and scale of economies are additional benefits.

"Increased flexibility to respond to seasonal changes in the fuels market is possible when you have an integrated complex," Mr. Logani said. "Integration will always give you mutual benefits here."

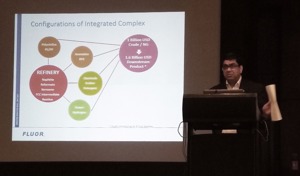

Case study 1: Refinery/petrochemical synergies. The Principal Engineer then discussed two refinery/petrochemical integration case studies performed by Fluor.

In the first, a feasibility study was performed for the integration of a 1,000-Mtpy, standalone petrochemical complex based on imported naphtha, with a mega-refinery in Southeast Asia. Fluor examined dedicated versus integrated utilities and offsites systems. Selection drivers included lifecycle cost and maintainability.

"A very important benefit [of the integration] was a reduction in hydrogen generation unit capacity by 25%," Mr. Logani explained. "The reason? A lot of hydrogen from the petrochemical plant was going back to the refinery."

Major savings areas in utilities and offsites included a 50% reduction in imported naphtha, a near-100% reduction in imported LPG inventory, and shared storage with the refinery for H2, C3= and C4.

Also, the complex was able to switch to river water from sea water for its raw water and cooling water needs. "The river water was cheaper to process than the seawater, making it a major area where we could save some money," Mr. Logani said.

Case study 2: Gas processing feeding to petrochemical. The second case study involved a linear programming modeling exercise to demonstrate varying levels of integration for a 12-Bcmy gas processing plant and a petrochemicals plant. The impacts of integration on operating cost, and simple payback by monetizing different intermediate streams, were studied.

In closing, Mr. Logani noted that, based on the second case study, monetizing stranded streams can boost operating margins by 45%–70%. Although the net effects after investment cost changes are much lower, simple payback can still be improved by 10%–25%.

A full study would need to be performed to consider additional investment cost changes, Mr. Logani noted.

IRPC 2017 is taking place at the Taj Palace in New Delhi from April 18–20.

Comments