Shale boom not cutting US polyethylene user costs

By JAMES R. HAGERTY

LOGAN TOWNSHIP, N.J. -- Heritage Bag Co., which makes plastic trash bags around the clock at a factory here, should be sitting pretty.

Heritage's main raw material, polyethylene, is derived from natural gas. As the US ramps up production of gas released from underground shale formations, output of polyethylene is expected to soar too, creating the potential for lower prices.

"I think it's our duty to use this gift of shale gas to rebuild our industrial infrastructure," says Jim Morris, a bluff Texan who serves as chief operating officer of privately owned Heritage.

There's just one problem: Heritage and other US users of polyethylene -- makers of plastic bags, toys, housewares and myriad other items -- aren't benefiting yet. They may not benefit for years and can't be sure it will fundamentally change the economics of their businesses.

Despite the shale boom, the price of polyethylene in the US has generally risen over the past few years. The type Heritage uses typically costs around 75 cents/lb, up from an average of 64 cents in 2010, according to IHS, a research firm.

Polyethylene makers, such as ExxonMobil and Dow Chemical, are enjoying lower costs because higher natural gas production increases the supply of ethane, a component of natural gas used to make polyethylene. Instead of passing on lower costs to their customers, however, they are reporting fatter profit margins.

First-half earnings before interest, tax, depreciation and amortization in Dow's performance plastics division, which makes polyethylene, were up 33% from a year earlier.

The polyethylene producers are making "insane amounts of money," Mr. Morris. He isn't, he says.

The polyethylene producers are making "insane amounts of money," Mr. Morris. He isn't, he says.

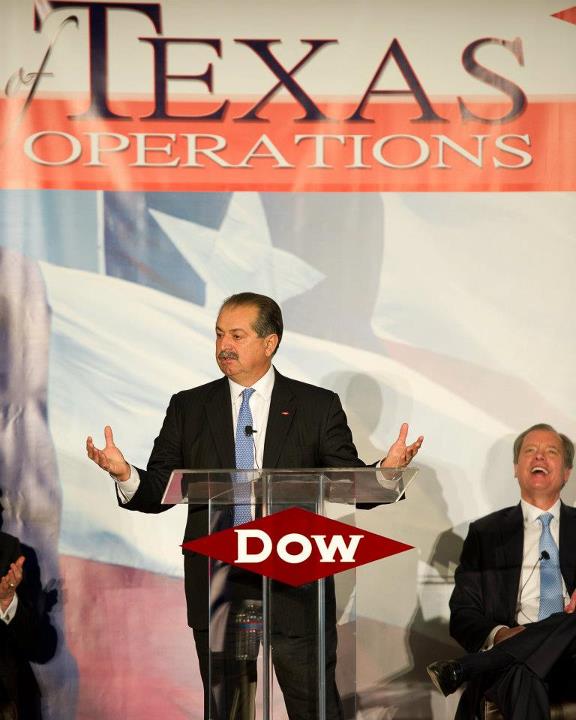

Dow Chemical's CEO, Andrew Liveris, two years ago published a book called "Make It in America," suggesting ways to revive American manufacturing. Now, says Mr. Morris of Heritage, Mr. Liveris has a chance to "put his money where his mouth is."

Mr. Morris argues that Dow and other chemical makers should try to ensure that the shale boom will lead to more US output of finished plastic goods, such as the trash bags made by Heritage, rather than just more exports of polyethylene to his overseas rivals.

In recent years, polyethylene prices have been higher in the US than in Asia, where big chemical companies from both the Middle East and the US battle for market share. Mr. Morris would like a promise from Dow and other polyethylene makers that their customers in the US won't have to pay more than customers in other parts of the world. So far, he hasn't received such pledges.

A Dow spokeswoman declined to comment on Mr. Morris's suggestion but said the shale boom is "a once-in-a-lifetime chance for the US to regain its competitiveness in manufacturing."

Polyethylene accounts for around 70% of the cost of making a plastic bag; the other main costs include labor and electricity.

Heritage, based in Carrollton, Texas, has annual sales of more than $400 million and bills itself as one of the world's largest makers of plastic trash bags used by restaurants, stadiums and other institutional customers. With six plants scattered around the US, Heritage employs about 750 people.

Heritage's plant here in Logan Township, N.J., smells faintly of melting plastic. Polyethylene pellets arrive via a railroad line alongside the plant. The pellets are pumped through tubes into silos and later into the factory, where they are melted in an extruder. Blasts of air blow the molten plastic into a bubble that resembles a giant cigar, rising 10 yards or more. The plastic solidifies into a film as it cools; then it is shaped and sliced into trash bags.

Workers in shorts and T-shirts tuck the bags into boxes and load pallets for shipment. The plant also provides jobs for managers and machine-maintenance people, among others.

Heritage and other US users of polyethylene eventually will get lower prices, once new production capacity is completed in 2016 and beyond, predicts Nick Vafiadis, a senior research director at IHS.

Dow, Royal Dutch Shell and others plan to spend billions of dollars to expand US production of petrochemicals, including polyethylene. Mr. Vafiadis forecasts that US polyethylene capacity will rise more than 30% by 2018 and nearly 60% by 2023.

Most of that increased production will be exported, Mr. Vafiadis believes, but he expects US buyers like Heritage will benefit too.

Mr. Morris says Heritage would like to expand its US production capacity and increase its exports, currently small. But that could happen only if Heritage is convinced that its polyethylene costs will be globally competitive.

The US is already a big exporter of polyethylene and other resins, made from oil or natural gas, but has a large trade deficit on plastic products, such as bags and packaging film, made out of those resins. The deficit totaled $2 billion in this year's first half.

Heritage's Mr. Morris says imports of the types of trash bags his company makes are fairly small. But Chinese and other Asian companies account for around one-third of the market for plastic shopping bags often used at grocery and other retail stores, despite import duties imposed by the US on those bags.

Stanley Bikulege, chief executive of Hilex Poly Co., a big US maker of plastic shopping bags, says he believes the shale boom will help make Hilex more competitive by holding down raw material costs. Hilex mainly focuses on its home market but is looking at the possibility of more exports. "Is [exporting] a huge opportunity for us?" Mr. Bikulege says. "Probably not."

William Carteaux, chief executive of the Society of the Plastics Industry, a trade group, says he sees scope for greater US exports of products containing plastic, including auto parts and such health-care items as blood bags and catheters.

At IHS, Mr. Vafiadis sees a "renaissance" in the US plastics industry.

For Mr. Morris, however, it is too early to celebrate. Before embarking on expansion plans, Heritage is waiting for assurances on raw-material costs.

"Entrepreneurs will take risks if there's a clear path to the payoff," he says.

Dow Jones Newswires

Comments