US refiners seek alternatives to Canada oil sands crude

NEW

YORK/HOUSTON (Reuters) - US Midwest refiners are rushing to secure alternatives

for crude supply as they worry about prolonged outages after a raging wildfire

in Canada shut nearly half of production capacity from the vast oil sands.

Even with

some 1 MMbpd in Canadian production capacity still offline due to the massive

wildfire, sufficient US supply is no problem, traders said. They pointed to

record crude stocks at the US hub of Cushing, Oklahoma, swelling domestic

supplies, as well as growing imports from Latin America, West Africa and the

Middle East.

Still, they

said, refiners with a large appetite for Canadian crude may have trouble

getting alternative supplies fast enough. Those facilities may include BP PLC's

Whiting, Indiana refinery and Phillips 66's Wood River, Illinois refinery.

For now, they will pull crude from their own storage tanks or get it from Cushing or the Gulf, reversing trade flows that have prevailed during the US shale boom, traders and analysts said.

But some

refiners without accessible crude supply and with tighter margins may have to

cut refinery runs, analysts said. This could exacerbate the swollen US crude

glut and add more pressure to oil prices.

While US

refinery margins saw a big spike on Wednesday, they are below their five-year

average for this time of year, Reuters Eikon data showed.

Logistical lag time and alternative

sources. Refiners in

the eastern part of the US Midwest, still reeling from the unplanned Keystone

pipeline outage last month, will be left without Canadian supply, said Dominic

Haywood, an analyst at Energy Aspects in London.

"They

will likely rely on inventory in the first instance, but for some plants this

will not be sufficient to sustain runs if inflows from Canada remain

subdued," he said, adding that the long transit time from other market

hubs and softer margins could mean "unavoidable" run cuts.

The rush to supply crude to the Midwest was apparent this week on news that volumes will more than double in May on the largest US pipeline, the 1.2-MMbpd Capline running from the US Gulf to the Midwest. Yet even that increase still represents only half its nameplate capacity.

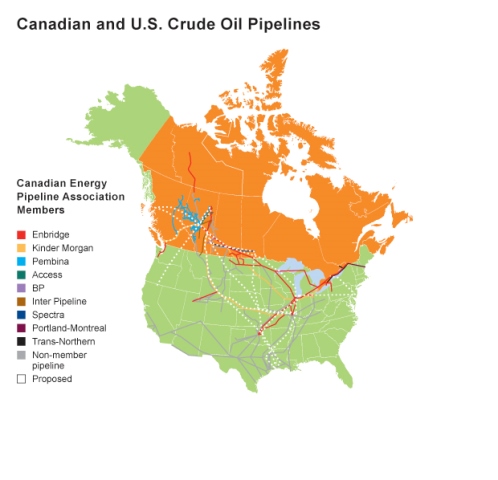

Traders noted

that other pipelines providing crude to the Midwest, including Enbridge's Ozark

and BP1 pipelines, still have additional capacity.

Analysts

predicted that the logistical lag time will result in some backlogs for

refiners already starved from their typical Canadian diet for more than a week.

This includes

Husky's Lima refinery, which was wrapping up a major eight-week turnaround at

the end of April as it tries to process more heavy crude feedstock.

US imports of

Canadian crude rose to 2.95 MMbpd last Friday. Production cuts due to the fire

should put a big dent in that this week.

Traders said

other imports, though plentiful, will need time to move to the Midwest. US

imports of West African crude are expected to rise in May to the highest since

October 2013. Iraqi imports should hit the most since at least the start of

2015, according to Eikon data.

Latin

American crude, which would be a natural replacement for Canadian oil due to

quality, has also had some setbacks as several outages have forced countries, including

Brazil and Venezuela, to reduce exports. US imports of Latin American crude are

expected to grow 3.3% in May from April.

Despite the

regional constraints, the futures and cash markets have largely shrugged off

the fire. In the cash market, Light Louisiana Sweet and Mars Sour, the US Gulf

Coast light and sour benchmarks, respectively, moved little this week as a glut

in the US Gulf Coast grows, where some spots show delays of up to two weeks in

offloading crude.

(Reporting by Catherine Ngai, Marianna

Parraga and Jarrett Renshaw; Editing by David Gregorio)

Comments