EIA: Hydrocarbon gas liquids a key factor in overall liquid fuel balance changes

Hydrocarbon gas liquids (HGL) — a group of products that includes ethane, propane, normal butane, isobutane, natural gasoline, and refinery olefins — have traditionally accounted for only minor changes in global liquid fuels production and consumption balances. However, HGL, and in particular ethane, is becoming a significant factor in expected year-over-year changes in global liquid fuels balances.

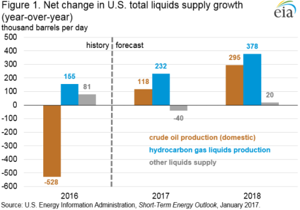

In EIA's January Short-Term Energy Outlook (STEO), most of the forecast increases to US liquids supply and consumption in 2017 and 2018 are the result of changes in HGL. Of the forecast growth in total world consumption of petroleum and other liquids from 2017 to 2018, over 13% can be attributed to US HGL demand growth alone. Similarly, most of the forecast increases in US total liquids supply is expected to come from production of HGL, rather than increases in US crude oil production. The forecast increase in HGL production represents 75% of the growth in US total liquids supply from 2016 to 2017 and 55% from 2017 to 2018.

HGL are present in both crude oil and raw natural gas production streams. Until 2010, about three quarters of US HGL production came from natural gas processing facilities, with the remainder being produced at refineries. However, with the large increase in US natural gas production and the build-out of infrastructure to extract and transport HGL that has occurred since 2010, supply of HGL from natural gas processing plants has grown rapidly. This trend is expected to continue, with natural gas processing plant production of HGL forecast to increase by 590,000 barrels per day (bpd) to 4.1 MMbpd between 2016 and 2018. In comparison, refinery and blender net production of HGL is expected to increase marginally by 10,000 bpd in both 2017 and 2018, averaging 660,000 bpd in 2018.

The presence of HGL in natural gas increases its heat content. To meet limits set by pipeline and natural gas utility rules, a portion of the HGL content is extracted from the wet natural gas. The HGL with highest value, and that have pre-established infrastructure and markets, are typically extracted to the greatest extent. With rapid growth in wet natural gas production in recent years some HGL such as propane, which is used as a space heating fuel, petrochemical feedstock, and to a lesser extent for agricultural and transportation exceeded domestic market demand. Large investments in US export capacity and international petrochemical facilities over the past several years have helped increased supplies find markets.

Ethane, however, is used almost exclusively as a feedstock for ethylene production at petrochemical plants. Ethane previously lacked the extensive infrastructure and petrochemical demand to make its widespread extraction from the natural gas stream economically feasible, but ethane represents most of the HGL forecast growth between 2016 and 2018. Natural gas plant production of ethane is forecast to increase by 450,000 bpd over the forecast period, from 1.25 MMbpd in 2016, to 1.70 MMbpd in 2018.

The forecast increase in ethane production is related to the recently completed infrastructure projects to recover and transport ethane, initially enabling an increase in consumption at existing petrochemical plants. In 2017 and 2018 stronger growth is expected as a series of new petrochemical plants ramp up operations. As a result US ethane consumption, which averaged an estimated 1.1 MMbpd in 2016, is forecast to increase by 110,000 bpd in 2017 and by 180,000 bpd in 2018.

Overall, HGL consumption is expected to be a major contributor to overall US liquid fuels consumption growth in the forecast period. HGL consumption fell by an estimated 30,000 bpd in 2016, but is projected to increase by 90,000 bpd in 2017 and 200,000 bpd in 2018. In comparision, consumption growth for motor gasoline is projected to increase by 40,000 bpd in 2017, and 90,000 bpd in 2018, and diesel consumption growth is projected to increase by 110,000 bpd in 2017, and 70,000 bpd in 2018.

The growth in HGL consumption is not limited to the United States. Investments in petrochemical facilities and other HGL infrastructure have also taken place abroad, in countries like China and India. Last year's significant rise in the use of HGL in China is expected to continue through at least 2017 as new propane dehydrogenation (PDH) plants contribute to rising propane use. In India, consumption growth averaging 0.2 MMbpd in both 2017 and 2018 is expected to result from increased use of transportation fuels and of naphtha and imported ethane for new petrochemical projects.

The growing importance of HGL presents a relatively new set of market conditions related to global total liquid production and consumption balances. In the United States, most of the growth in HGL supply is from non-crude, non-refinery sourced production, and these hydrocarbons may compete in markets typically supplied with refinery-produced products. For example, propane, ethane, and natural gasoline produced from raw natural gas compete with refinery-produced naphtha to supply the petrochemical feedstock market. While crude oil and refinery-produced products will continue to supply the vast majority of the world's demand for liquid fuels, the accounting of HGL will become an increasingly important factor in year-over-year changes in liquid fuel balances.

US average regular gasoline and diesel retail prices fall

The US average regular gasoline retail price fell three cents from the previous week to $2.36 per gallon on January 16, up 44 cents from the same time last year. The Midwest price fell six cents to $2.28 per gallon, the Gulf Coast price fell three cents to $2.14 per gallon, and the East Coast price fell two cents to $2.37 per gallon. The West Coast and Rocky Mountain prices each rose less than one cent and remained at $2.68 per gallon and $2.26 per gallon, respectively.

The US average diesel fuel price dropped one cent to $2.59 per gallon on January 16, 47 cents higher than a year ago. The West Coast and Gulf Coast prices each fell two cents to $2.86 per gallon and $2.43 per gallon, respectively. The East Coast and Midwest prices each fell one cent to $2.64 per gallon and $2.54 per gallon, respectively, while the Rocky Mountain price fell less than one cent and remained at $2.54 per gallon.

Propane inventories fall

US propane stocks decreased by 7.4 million barrels last week to 72.2 million barrels as of January 13, 2017, 17.7 million barrels (19.7%) lower than a year ago. Gulf Coast, Midwest, East Coast and Rocky Mountain/West Coast, inventories decreased by 4.5 million barrels, 2.1 million barrels, 0.6 million barrels, and 0.2 million barrels, respectively. Propylene non-fuel-use inventories represented 5.8% of total propane inventories.

Residential heating oil price decreases while propane price increases

As of January 16, 2017, residential heating oil prices averaged just under $2.64 per gallon, nearly one cent per gallon less than last week's price but 52 cents per gallon higher than last year at this time. The average wholesale heating oil price is nearly $1.73 per gallon, just under five cents per gallon less than last week but 73 cents per gallon higher than a year ago.

Residential propane prices averaged just under $2.33 per gallon, up nearly three cents per gallon from last week and almost 31 cents per gallon more than a year ago. Wholesale propane prices averaged $0.87 per gallon, over one cent per gallon higher than last week and 46 cents per gallon higher than last year's price.

Comments