EIA: US crude, petroleum product exports rising, trends vary across products

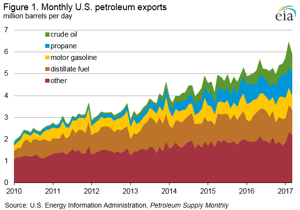

US total crude oil and petroleum product exports more than doubled from 2.4 MMbpd in 2010 to 5.2 MMbpd in 2016. While exports of distillate, gasoline, propane and crude oil have all contributed to the increase, growth rates and market drivers for each product have varied during this period.

Crude Oil

Restrictions on exporting domestically-produced crude oil were lifted in December 2015, and in 2016, the United States exported 520,000 bpd. US crude oil exports reached 1.1 MMbpd, the highest monthly level recorded to date, in February 2017. While Canada remains the largest destination for US crude oil exports, its share of total US crude oil exports has declined, dropping from 92% in 2015 (427,000 bpd) to 58% in 2016 (301,000 bpd). Other leading destinations for US crude oil exports in 2016 included the Netherlands, Curacao, China, Italy, and the United Kingdom. In addition to export restrictions, the level of US crude exports are sensitive to price differentials, shipping costs, and the level of domestic production. US production fell through the first nine months of 2016, but rose at the end of 2016 and the first five months of 2017. In 2016, US crude oil exports increased 55,000 bpd over 2015, but year-over-year growth in both 2014 (217,000 bpd) and 2015 (114,000 bpd) were considerably higher.

Distillate

US exports of distillate also experienced slower year-over-year growth rates compared with recent years. In 2016, the United States exported 1.2 MMbpd of distillate, the country’s largest petroleum product export. Between 2010 and 2016, US exports of distillate grew by 81% (534,000 bpd), but most of this growth occurred between 2011 and 2013. The largest destination for US distillate exports is Mexico, averaging 182,000 bpd in 2016, followed by Brazil (125,000 bpd), and the Netherlands (108,000 bpd).

Gasoline

US exports of total motor gasoline have increased by 126% (425,000 bpd) since 2010. The growth in gasoline exports took place while domestic consumption, as measured by product supplied, was also increasing. Mexico is the top destination for US total motor gasoline exports and the volume of gasoline trade is significant to US refineries. Over the past five years, US exports to Mexico accounted for between 44% (2014) and 53% (2016) of total US gasoline exports.

Propane

Unlike the recently slowing increases in US exports of crude oil, distillate fuel, and motor gasoline, propane export growth has recently accelerated. Propane exports differ from other US petroleum exports with respect to where they are shipped. Whereas most other US petroleum exports stay in the Western Hemisphere, Japan and China are the top destinations for US propane exports. Propane has many non-transportation sector end uses, including space heating, cooking, and as a petrochemical feedstock.

Comments