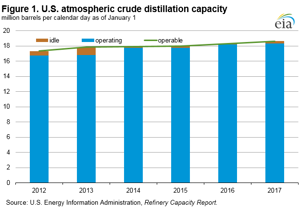

US refinery capacity at the start of 2017 is 1.6% above its year-earlier level

As of Jan. 1, 2017, US operable atmospheric crude distillation capacity reached 18.6 MMbpcd, 1.6% higher than at the beginning of 2016 according to EIA's recently released annual Refinery Capacity Report. This increase in operable capacity was the second largest since the 2.9% increase from January 2012 to January 2013, which reflected the restart of East Coast refineries that had closed in 2011. The capacities of secondary units that support heavy crude processing and production of ultra-low sulfur diesel and gasoline, including thermal cracking (coking), catalytic hydrocracking, and hydrotreating/desulfurization also increased. Catalytic hydrocracking and deasphalting units experienced the largest capacity increases over the past year, rising by 4.5% and 6.1%, respectively.

The refinery capacity reported for the start of 2017 includes one new unit, the Magellan Midstream Partners LP 42,500 bpcd condensate splitter in Corpus Christi, Texas. Condensate splitters are distillation units that process condensate, which is lighter than crude oil. Splitter capacity is included as atmospheric distillation units in EIA data. The Magellan Midstream Partners LP unit, which began operating in 2017, was operable but not running at the start of the year, so its capacity was listed as idle in the Refinery Capacity Report.

Gross inputs to refineries, also referred to as refinery runs, averaged 16.5 MMbpd in 2016, the highest level ever, 84,000 bpd above the 2015 level and 1.1 MMbpd higher than in 2012. US crude oil production decreased by 0.5 MMbpd in 2016 compared with 2015, the first decline since 2008. To offset the decline in production, net imports of crude oil increased by a similar amount. Despite the increase in refinery runs, capacity increased even more, lowering refinery utilization in 2016 compared with 2015.

US regular gasoline retail prices fall, diesel retail prices climb

The US average regular gasoline retail price fell three cents from the previous week to $2.26/gal on July 3, down three cents from the same time last year. The Gulf Coast price fell nearly five cents to $2.01 per gallon, the Rocky Mountain price fell four cents to $2.35/gal, the Midwest price fell three cents to $2.14/gal, the East Coast price fell over two cents to $2.20/gal, and the West Coast price fell one cent to $2.82/gal.

The US average diesel fuel price rose nearly one cent, remaining at $2.47/gal on July 3, five cents higher than a year ago. The Midwest price rose nearly two cents to $2.40/gal, the East Coast price rose nearly one cent, remaining at $2.52/gal, and the West Coast and Gulf Coast prices remained rose less than one cent, remaining at $2.76/gal and $2.31/gal, respectively. The Rocky Mountain price fell nearly one cent, remaining at $2.59/gal.

Propane inventories gain

US propane stocks increased by 2.1 MMbbl last week to 60.6 MMbbl as of June 30, 24.2 MMbbl (28.6%) lower than a year ago. Gulf Coast and Midwest inventories increased by 1.4 MMbbl and 0.7 MMbbl, respectively, while East Coast and Rocky Mountain/West Coast inventories remained essentially unchanged, with a marginal increase and decrease, respectively. Propylene non-fuel-use inventories represented 4.8% of total propane inventories.

Comments