EIA: More US distillate is being exported

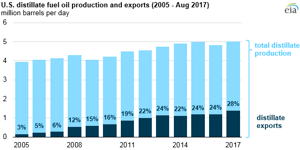

US distillate exports have continued to increase in 2017, both in volume and as a share of total distillate production. Domestic distillate demand has remained relatively stable, increasing slightly from January through July 2017.

Distillate exports from the United States reached a record high in July 2017 of 1.7 MMbpd. In August, exports of distillate fell to 1.4 MMbpd when Hurricane Harvey resulted in port closures. Based on data through August, distillate exports have accounted for 28% of the total distillate produced in the United States in 2017.

US distillate exports in 2017 have been destined primarily for countries in Central and South America, Europe, and North America. The proximity of US Gulf Coast refineries to Mexico and to Central and South America, combined with these regions’ high demand and recent refinery shutdowns, have led to strong US distillate exports to these locations. In addition to increased export demand, the difference between distillate prices and crude oil prices encouraged relatively high refinery runs.

The largest single recipient of US distillate exports from January through July 2017 was Mexico (228,000 bpd), followed by Brazil (183,000 bpd) and the Netherlands (102,000 bpd). For North America, although exports to Canada decreased by 15,000 bpd compared with the same months in 2016, exports to Mexico increased by more than 76,000 bpd.

January through July distillate exports to Brazil increased by 83,000 bpd from 2016 levels to 183,000 bpd in 2017. Trade press reports indicate that the decision by Brazil’s state-controlled oil company, Petroleo Brasileiro SA, to raise diesel prices in April, combined with competitive tanker rates, supported US exports to Central and South America.

Despite refinery outages in Europe, average US distillate exports to the region decreased in 2017 compared with 2016. January through July 2017 exports to Europe averaged 280,000 bpd, nearly 42,000 bpd lower than the average for the same period last year. According to trade press reports, Europe is receiving distillate from a more diversified group of suppliers. If the United States continues to lose market share among European countries, distillate exports to Central and South America may increase faster than otherwise expected.

Comments