Key steps for refiners ahead of IMO 2020 - Shell Global Solutions

The reality is that many refiners remain unprepared for the International Maritime Organization’s (IMO) MARPOL 73/78 Annex VI (IMO 2020). These regulations, which will substantially tighten the global cap on the maximum sulphur content of marine fuel oil, could have a major impact on an ill-equipped refiner’s profitability. Fortunately, it is not too late; they could implement several low-cost solutions over the next two years to safeguard their competitive position.

Because of these regulations, from 2020, refiners can expect demand for high-sulphur fuel oil (HSFO) to fall, demand for low-sulphur fuel oil (LSFO) to increase and a corresponding price differential between the two to open up. This is because ships will only be able to continue using HSFO if they are fitted with on-board scrubbers, but on-board scrubbers are costly and it will only be possible to convert a modest percentage of the world’s fleet before the new global cap comes into force. Liquefied natural gas conversions are inappropriate for most ships, so most will turn to LSFO from 2020.

Fortunately, the LSFO–HSFO price differential is likely to close partially over time as scrubber technology improves and conversion facilities are built. Consequently, there will still be a market for HSFO and refiners do not necessarily need to eliminate their HSFO exposure, but they would be well advised to reduce it to retain their competitiveness.

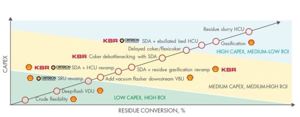

How should you respond? There is a wide range of technology options available, but a rigorous evaluation study must be done to find the most cost-effective option for each refinery. Some of these options are shown in Figure 1. Should you install one of the highest-residue-conversion technologies, for example, ebullated-bed residue hydrocracking or slurry-phase residue hydrocracking? For many refiners, these options may not provide the optimum solution, in part because they are extremely capital intensive.

Shell Global Solutions helps identify the best responses. The business case for some of the integrated solutions, which often involve revamping existing process units, has tended to be far stronger than that for installing new high-residue-conversion technology.

For example, a solvent deasphalting (SDA) unit can be added for comparatively moderate capital expenditure (capex). Simultaneously revamping the hydrocracker can help to reduce HSFO production by almost 50%, increase middle distillates yield and improve crude flexibility.

The combination of SDA and deasphalted oil hydrocracking, or SDA and thermal conversion, which is another moderatecapex response option, has another important advantage: it retains high levels of crude flexibility. This is becoming an increasingly important profitability driver for refiners. There are large opportunities for refiners to increase margins by including lower-priced, opportunity or niche crudes in their diet, so you should always evaluate the effect that your investments will have here.

Another crucial consideration is the refinery’s back end. When increasing the level of residue conversion, by either revamping process units or installing new ones, the treating and utility systems and logistics infrastructure can often be key constraints. Additional capacity is likely to be required for sour water strippers, wastewater treatment plants and, particularly, sulphur recovery units. Fortunately, the state of the art has recently advanced here with the development of Shell’s next-generation tail gas treating process, Shell Claus off-gas treating (SCOT1) ULTRA, which offers a performance step change for minimal investment.

Of course, the gestation period of all such projects is likely to extend beyond 2020, so it may be too late to initiate such a response now to reap the benefits of the expected LSFO– HSFO price differential. They may remain options for the long term however, although refiners who have not already committed to this type of long-term, high-capex investment are likely to delay making an investment decision until at least 2019 when the supply, demand and economic implications of IMO 2020 should become clearer.

What changes could you implement before 2020? Among the low-capex, quick-win solutions that have scored highly in our analyses is Shell’s deep-flash technology, which can help to lift more and better quality vacuum gas oil (VGO) from the vacuum distillation unit and reduce HSFO production. Another popular solution is installing latest-generation reactor internals and catalysts, which can enable the hydrotreating and hydrocracking of heavier and more difficult feeds such as deasphalted oil, heavy VGO and visbreaker VGO, and increase conversion capability.

Another quick-win opportunity is to change the crude diet to include a proportion of opportunity crude. For a typical 200,000-bbl/d refinery, the inclusion of 10% of an opportunity crude with a relative discount of $1/bbl could increase the gross refinery margin by some $7 million a year. This will typically require no capex.

The importance of first developing a robust investment plan tailored to your specific circumstances cannot be overemphasized. You can only identify the optimum solution by taking into account your specific constraints, such as refinery configuration, local factors and available capital, and by using tools such as scenario planning to help you take a view of the future market in which you will be operating.

Meeting IMO regulations will be a major theme of Hydrocarbon Processing’s IRPC Europe event, which will be held in Milan, 5-7 June 2018.

Steps for refiners ahead of IMO 2020 is from a Shell Global Solutions report, "Key steps for refiners ahead of IMO 2020."

Key takeaways

◾IMO 2020 will cause a price gap to open up between LSFO and HSFO that only the best-prepared and equipped refiners will benefit from, and this gap will close partially over time.

◾To reap the benefits of this price gap, a refiner would need to have already invested in a medium- to highcapex solution that suits their particular circumstances.

◾Those that have not could focus on what they can achieve ahead of 2020. From installing deep-flash technology and revamping with latest-generationcatalysts and reactor internals through to including low-cost opportunity crudes in the refinery diet, there are many steps for strengthening competitiveness ahead of 2020.

1 SCOT is a trademark owned by the Shell group of companies.

Comments