U.S. ethane consumption, exports to increase as new petrochemical plants come online

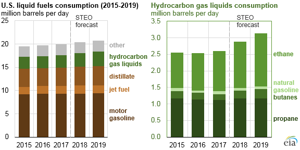

Over the next two years, EIA’s Short-Term Energy Outlook (STEO) projects growth in U.S. consumption of ethane in the petrochemical industry will exceed increases in consumption of all other petroleum and liquid products—such as motor gasoline, distillate, and jet fuel—combined. EIA also projects that ethane exports will continue increasing, as ethane is exported both by pipeline to Canada and by tankers to more distant destinations.

Ethane is separated from raw natural gas at natural gas processing plants along with other hydrocarbon gas liquids(HGL) such as propane, normal butane, isobutane, and natural gasoline. Ethane is mainly used as a petrochemical feedstock for the production of ethylene, which is a building block for plastics, resins, and other industrial products.

As U.S. natural gas production has increased, the amount of ethane contained in raw natural gas production streams has exceeded domestic demand or the ability to export it abroad. This situation has led producers to leave some of the ethane in the natural gas stream, up to allowable limits set by natural gas pipelines and distribution systems, and to sell it as natural gas, rather than recover and market ethane as a separate product.

Nonetheless, ethane is increasingly being recovered from the natural gas stream, and U.S. ethane consumption is increasing as existing ethylene crackers have expanded and new plants have begun operating. In addition, expanding pipeline networks and two new ethane export terminals have allowed U.S. ethane exports to increase.

In 2017, construction was completed on the first three of a series of new ethylene crackers—two early in the year and a third in late December, all on the Texas Gulf Coast. These crackers expanded the capacity to consume ethane in the United States by 210 Mbpd, and EIA expects ethylene plant capacity to continue to expand: six ethylene crackers, collectively capable of consuming 380 Mbpd of ethane, are planned to be completed by the end of 2019. EIA expects annual U.S. ethane consumption to grow from an estimated 1.2 MMbpd in 2017 to 1.4 MMbpd in 2018 and 1.6 million MMbpd in 2019 as these new plants and related infrastructure ramp up operations.

EIA also projects continued growth in ethane exports, with average annual exports increasing from 180 Mbpd in 2017 to 290 Mbpd in 2018 and 310 Mbpd in 2019. Ethane exports by pipeline to Canada are expected to increase in early 2018 as shipments on the Utopia pipeline that crosses the U.S.-Canada border near Detroit begin to flow and as an ethylene plant in Sarnia, Ontario, expands capacity.

Ethane is also exported by tanker from terminals at Marcus Hook, Pennsylvania, and Morgan’s Point, Texas, which both opened in 2016. Ethane shipments from these facilities currently supply petrochemical feedstock to countries including the United Kingdom, Norway, Sweden, India, and Brazil. By the end of 2019, ethane exports from the United States may also reach China when a new ethylene plant there begins operation.

Principal contributors: Stacy MacIntyre, Warren Wilczewski

Comments