China's teapots buy Iranian oil to replace Venezuelan supply

- Teapots draw on Iranian oil stocks in tanks, ships

- Iranian oil cheapest among Venezuelan replacements

- Venezuelan crude in floating storage in Asia nearly halves in January

Chinese independent refiners are buying discounted Iranian heavy crude to replace Venezuelan shipments that have stalled after the U.S. claimed control of the OPEC producer last month, two people with knowledge of the matter said on Monday.

The drawdown of Iranian oil held in storage is making up for the drop in Venezuelan supply to the world's largest crude importer, they said.

Venezuelan shipments to China have fallen sharply since mid-December after U.S. President Donald Trump imposed a blockade on sanctioned ships, part of a campaign against President Nicolas Maduro which culminated in his capture by U.S. forces on January 3. Trump has said the U.S. intends to control Venezuela’s oil sales and revenues indefinitely.

Washington has assigned global trading firms Vitol and Trafigura to sell up to 50 MMbbl of Venezuelan oil which state firm PetroChina held off from buying as it assessed the U.S.-controlled purchases.

Teapots seek Iranian Heavy and Pars crude. China's independent refiners, which used to be the biggest buyers of Venezuelan crude, have snapped up Iranian heavy crude stored in bonded storage tanks in China and on ships, the sources said.

The refiners, known as teapots and mostly based in the country's eastern Shandong province, prioritized purchases of sanctioned crude because of steep discounts, rather than buying Venezuelan cargoes marketed by Vitol or Trafigura, or heavy grades from Canada, traders said.

The teapots are seeking more shipments of Iranian Heavy and Pars crude grades for delivery to China later in February and March, one of the two sources added. They declined to be named due to the sensitivity of the matter.

Discounts of Iranian Heavy were about $12 per barrel to ICE Brent, making it the cheapest available substitute, the sources said. Russian Urals, another alternative, traded at a discount of $11 to $12 per barrel below ICE Brent for March delivery into China.

The teapots were unlikely to take up Vitol's offer to Chinese buyers of Venezuelan crude at discounts of roughly $5 per barrel to ICE Brent for April delivery, trade sources said last month, given the sharp increase in prices from a discount of about $15.

Venezuela supply falls. China's imports of Venezuelan crude averaged 394,000 bpd for 2025, or around 4% of China's total seaborne crude imports, data from analytics firm Kpler showed.

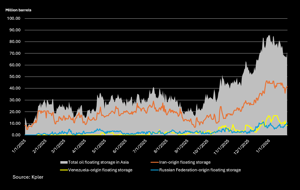

(click image to enlarge)

As the number of oil tankers departing Venezuela for China has fallen sharply, floating storage of Venezuela-origin crude oil in Asia slumped to 8.26 MMbbl on January 28, half of the 16 MMbbl at the start of 2026, Kpler data showed.

Meanwhile, Iranian oil stored on tankers in Asia dipped to 41.72 MMbbl from 46.25 MMbbl during the same period, the data showed.

Russia-origin crude floating storage in Asia climbed to a month's high above 10 MMbbl last week on lower demand from India and Turkey, according to Kpler.

Comments