Big Dakota pipeline to give Gulf Coast refiners another option for crude supply

(Reuters) It may seem odd that the opening of one pipeline crossing through four US Midwest states could upend the movement of oil throughout the country, but the Dakota Access line may do just that.

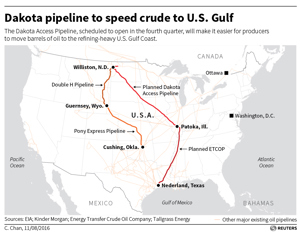

At the moment, crude oil moving out of North Dakota's prolific Bakken shale to "refinery row" in the US Gulf must travel a circuitous route through the Rocky Mountains or the Midwest and into Oklahoma, before heading south to the Gulf of Mexico.

The 450 Mbpd Dakota Access line, when it opens in Q4, will change that by providing US Gulf refiners another option for crude supply.

Gulf Coast refiners and North Dakota oil producers will reap the benefits. Losers will include the struggling oil-by-rail industry which now brings crude to the coasts.

The pipeline also will create headaches for East and West Coast refiners, which serve the most heavily populated parts of the United States and consume a combined 4.1 MMbpd. They will have to rely more on foreign imports.

The pipeline, currently under construction, will connect western North Dakota to the Energy Transfer Crude Oil Pipeline Project (ETCOP) in Patoka, Illinois. From there, it will connect to the Nederland and Port Arthur, Texas, area, where refiners including Valero Energy, Total and Motiva Enterprises operate some of the largest US refining facilities.

"That's a better and cheaper path than going out West and down through the Rockies," said Bernadette Johnson, managing partner at Ponderosa Advisors LLC, an energy advisory based in Denver.

CHEAPER THAN RAIL

Moving crude by pipeline is generally cheaper than using railcars. The flagging US crude-by-rail industry already is moving only half as much oil as it did two years ago: volumes peaked at 944 Mbpd in October 2014, but were around just 400 Mbpd in May, according to the US Energy Department.

Rail transport has become less economical for East and West Coast refiners when compared with importing Brent crude, the foreign benchmark, because declining supply out of North Dakota made that grade of oil less affordable.

"If you look at the Brent to Bakken arb, it's tight," said Afolabi Ogunnaike, a senior refining analyst at Wood Mackenzie in Houston. "If you look at the spot rate, it's uneconomical to move crude by rail right now."

Ponderosa Advisors estimated that the start-up of the pipeline could reroute an additional 150 Mbpd to 200 Mbpd currently carried by rail to the US East Coast and Gulf Coast.

Crude imports into the East Coast are now on the rise, averaging 788 Mbpd this year, with nearly 960 Mbpd in July, the highest level in three years, according to Thomson Reuters data.

On the West Coast, refiners like Shell, Tesoro and BP may have to commit to some railed volumes for longer because of shipping constraints, although it will largely depend on rail economics. They also face declining output from California and Alaska.

Tesoro's top executive Gregory Goff told analysts and investors last week he expects rail costs to drop as much as 40% from the current $9/bbl to$10/bbl cost to compete with pipelines, in order to move Bakken to its Anacortes, Washington, refinery.

CHANGING TIDES

Rail companies have been trying to adapt. CSX Corp, which runs a network of lines in the eastern part of the country, said it was evaluating potential impacts of the pipeline. BNSF Railway declined to discuss future freight movements, but said that at its peak, it transported as many as 12 trains daily filled with crude, primarily from the Bakken. Today, it is moving less than half of that.

In a recent earnings call, midstream player Crestwood Equity Partners said it was working to capitalize on the pipeline and not be dependent on loading crude barrels onto trains. That includes building an interconnection to its 160 Mbpd COLT crude rail facility in North Dakota.

As refiners bring in more barrels from overseas, Brent's premium over US crude will eventually widen. On Thursday, December Brent futures settled at a $0.97 premium to US crude, one of its widest premiums this year.

Separately, Bakken crude, a light barrel, could rise further due to the additional competition, especially as production is still falling. Bakken differentials hit a six-month low earlier this week of $2.65/bbl below WTI, according to Reuters data, but rose to a $1.80/bbl discount by Thursday.

Reporting by Catherine Ngai and Liz Hampton; Editing by David Gregorio

Comments