EIA: More Chinese crude oil imports coming from non-OPEC countries

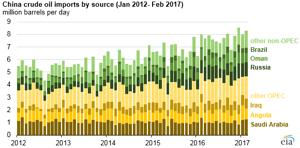

China is the world’s largest net importer of crude oil, and in recent years, China’s crude oil imports have increasingly come from countries outside the Organization of the Petroleum Exporting Countries (OPEC). While OPEC countries still made up most (57%) of China’s 7.6 MMbpd of crude oil imports in 2016, crude oil from non-OPEC countries made up 65% of the growth in China’s imports between 2012 and 2016. Leading non-OPEC suppliers included Russia (14% of total imports), Oman (9%), and Brazil (5%).

On an average annual basis, China’s crude oil imports increased by 2.2 MMbpd between 2012 and 2016, and the non-OPEC countries’ share increased from 34% to 43% over the period. Market shares for China’s top three non-OPEC suppliers (Russia, Oman, and Brazil), all increased over these years. While still comparatively small as a share of China’s crude oil imports, imports from Brazil reached a record high of 0.6 MMbpd in December 2016, and imports from the United Kingdom reached a high of 0.2 MMbpd in February 2017.

Growth in China’s total crude oil imports in 2016 reflected both lower domestic crude oil production and continued demand growth. After increasing steadily between 2012 and 2015, China’s crude oil production declined significantly in 2016. Total liquids supply in China averaged 4.9 MMbpd in 2016, a year-over-year decline of 0.3 MMbpd, the largest drop for any non-OPEC country in 2016. US crude oil production fell by more than 0.5 MMbpd in 2016, but total liquids declined by less than 0.3 MMbpd because other liquids production increased by less than 0.3 MMbpd.

Much of Chinese production growth from 2012 through 2015 was driven by more expensive drilling and production techniques, such as enhanced oil recovery (EOR) in older fields. As oil prices declined during 2016, investments in developing new reserves also fell and were not high enough to offset the natural production declines of older fields.

China’s demand growth has remained the world’s largest in every year since 2009, increasing 0.4 MMbpd in 2016. As China increased its imports to address a growing gap between its domestic production and demand, it surpassed the United States as the world’s largest net importer of total petroleum (crude oil and petroleum products) in 2014. The United States imports more crude oil and exports more crude oil and petroleum products than China.

Other factors contributed to an increase in Chinese crude oil imports. For example, in July 2015, the Chinese government began allowing independent refiners (those not owned by the government) to import crude oil. The independent refiners previously had restrictions on the amount of crude oil they could import and relied on domestic supply and fuel oil as primary feedstocks. Another factor is the Chinese government’s filling of new Strategic Petroleum Reserve sites.

EIA’s latest Short-Term Energy Outlook (STEO) forecasts a 0.3 MMbpd increase in China’s total liquid fuels demand in both 2017 and 2018. Absent any domestic production increases, China’s crude oil imports are expected to continue increasing. More information about China’s crude oil imports and various market forces that may suggest continued growth in non-OPEC crude oil imports are available in EIA’s This Week in Petroleum.

Comments